QuickBooks Online Electronic Payroll Tax Filing and Payment

- How to Electronically File and Pay Payroll Taxes in QuickBooks for Windows: Pro, Premier

- How to Electronically File and Pay Payroll Taxes in QuickBooks for Mac

How to Electronically File and Pay Payroll Taxes

in QuickBooks Online

QuickBooks Online has improved greatly since it was first created, and as such many of its features - including generating payroll as well as filing and paying payroll taxes have become so much easier to use. Follow the steps below to file and pay your payroll taxes in QuickBooks Online:

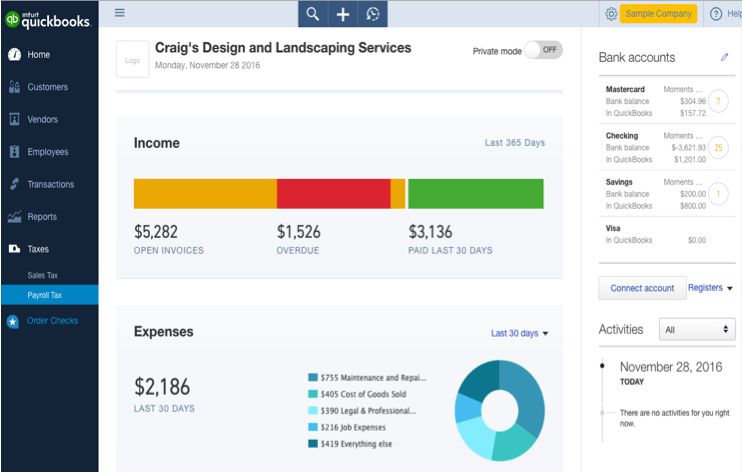

Step 1. From your QuickBooks Online homepage, go to Taxes at left menu bar, and select Payroll Tax as shown in screenshot below.

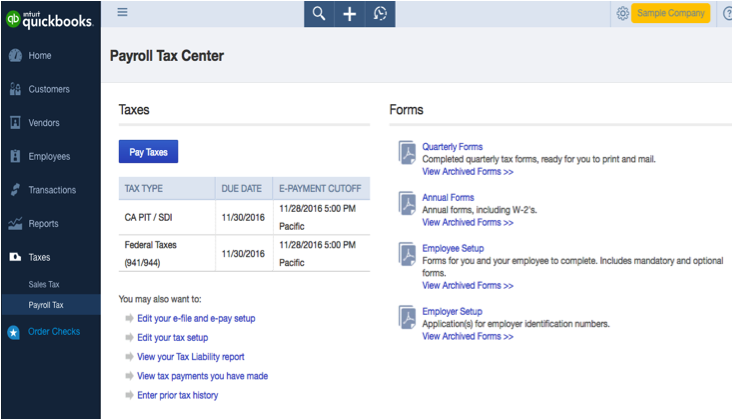

Step 2. In the Payroll Tax Center, click Edit your e-file and e-pay setup, under the Taxes column as shown in screenshot below.

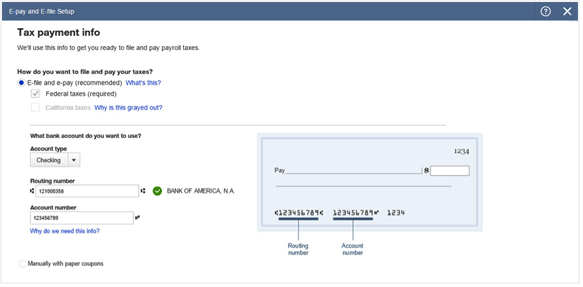

Step 3. Choose E-file and e-pay and select the State for which you are enrolling, then enter your company’s bank account information so that Intuit will be able to take the money from your bank and send electronically to the corresponding tax agencies.

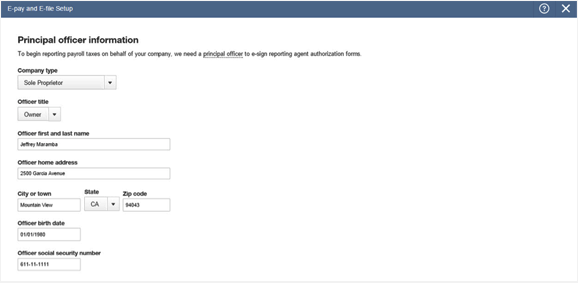

Step 4. Next, enter some personal information for your company’s principal officer (the main contact for the company bank account). This step is required to maintain your account’s security.

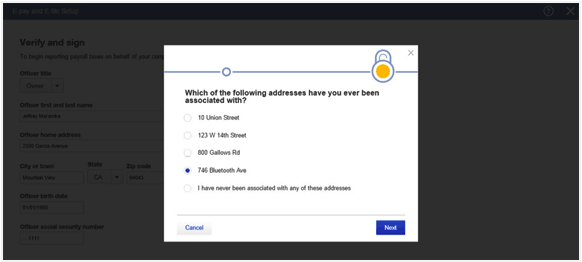

Step 5. To ensure the individual signed in to the account is the principal officer and not an imposter, QuickBooks Payroll asks some security questions to confirm the principal officer’s identity.

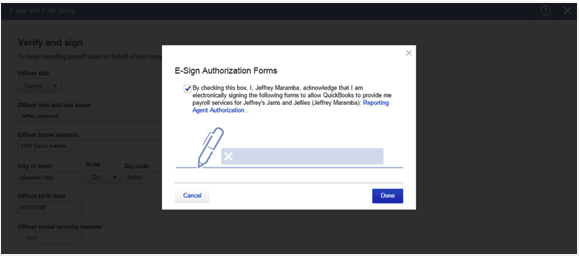

Step 6. Check the box to e-sign all your tax forms at once. You can also click the links to view the forms QuickBooks Payroll will send to the different tax agencies.

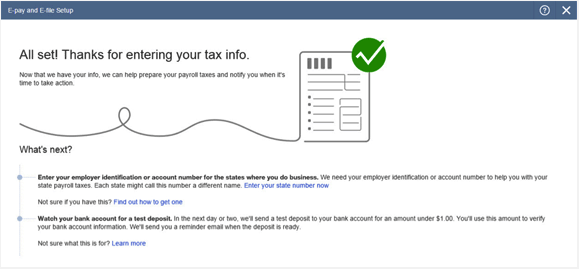

Step 7. That’s it for now, but there may be some additional steps to complete the enrollment. Every tax agency is unique, so Intuit gives you a personalized list with links and the details you need to guide you through the process for your specific state forms. To see this list go to Employees in left menu bar, then click Finish payroll tasks to the right of screen.

Intuit will send you email reminders when your payroll taxes are due, to ensure you take action before they are overdue and thus avoid penalties and fees.

.png)