QuickBooks Electronic Payroll Tax Filing and Payment

- How to Electronically File and Pay Payroll Taxes in QuickBooks Online

- How to Electronically File and Pay Payroll Taxes in QuickBooks for Mac

How to Electronically File and Pay Payroll Taxes

in QuickBooks (Pro, Premier, Enterprise)

QuickBooks Payroll for Windows platform - Pro, Premier, and Enterprise are housed on your computer's hard drive and thus more easily accessible, and a lot more flexible. It also makes filing and paying your payroll taxes more convenient. Follow the steps below to file and pay your payroll taxes in QuickBooks:

Step 1. Go to Employees in top menu bar, and select Payroll Tax Forms & W2's then Process Payroll Forms.

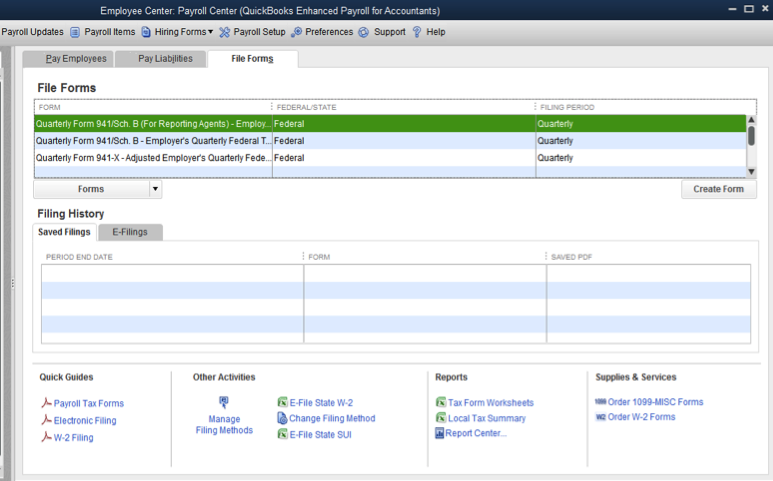

Step 2. In the Payroll Center, click the File Forms tab, and select the form you need to file from the list.

Step 3. Choose Create Form then select the form filing period and click Ok.

Step 4. Now, review the form and click Check for Errors. If there are errors, make the correction, then cick the Submit Form button.

Step 5. Click on the E-file button and follow the on-screen instructions to submit the form. You can switch between filing methods from the Payroll Center at bottom center, as shown in screenshot above.

.png)